As the NFL lockout enters its second month, players from at least 16 teams have already sought out extremely aggressive short-term loans with high interest rates, ThePostGame.com has learned.

According to a financing source, these interest rates range from 18 percent to 24 percent, and upon default, they can rise as high as 36 percent.

All of this comes as the NFL Players Association announced nearly two weeks ago it would begin payouts from its war chest -- a lockout fund designed to help keep players afloat during the work stoppage. But while that lifeline was created in part to keep opportunistic lenders at bay, the finances offered by the NFLPA -- as much as $60,000 for some players -- won’t solve all financial ills. And much to the chagrin of some members of the union, the high-risk loan market has begun to attract players.

"There are a lot of people out there pitching these things," an attorney who has advised players on such loans told ThePostGame.com on the condition of anonymity. "It’s almost predatory lending. It's people going to guys who they know are already in debt, or don’t have the ability to pay their bills during the year and [lending them money] at such obscene terms, that you say, 'Hey, no one would ever sign something like this.' But a lot of players are."

Much was made of the NFLPA's preparation for the current lockout, which focused on raising players' financial awareness and surviving a months-long battle with no paychecks in sight. The union even went as far as asking players to save a minimum of three game checks from the 2010 season, in hopes of staving off any financial peril this off-season. But one prominent financial adviser, who also spoke on the condition of anonymity, told ThePostGame.com that it's becoming clear many players didn’t follow the union's advice.

"I know at least 16 different teams that have had players go out and have to set these [high risk loans] up," said the adviser. "Guys on the Dolphins, Saints, 49ers, Panthers, Chargers, Bears, Vikings."

The adviser said he believes as many as 10 percent of the nearly 1,800 players in the league have secured some form of lending at this point, and estimates at least another 20 percent are in the process of securing lending now. Based on conversations he has had with other leading figures in the industry, he believes close to half of the players in the NFL will secure some form of lending if the lockout continues past Labor Day.

Legal and financial sources with ties to players say many affiliated with the high-risk loan industry are soliciting individuals close to cash-strapped players.

"[They] are your gray-area guys who aren't agents, aren't managers, aren't financial advisors," the financial adviser said of the loan industry middlemen. "And [they’re] getting fees of $100,000-$150,000 for getting players to sign off on the loans."

In order to ensure payment on the loans, financial sources say lenders are also requiring that players purchase insurance policies which guarantee payment in the event a player gets hurt. Sources say the premiums on those policies may reach as much as $200,000, which also provide additional kickbacks for middlemen.

And while many in the union look at the high-risk loans as a serious point of concern, Sherard Rogers -- who acts a financial advisor to a number of NFL players -- believes the loans are legitimate and are simply an example of supply meeting demand.

"There’s a market, there’s a demand, and I’m helping an industry that I benefit from also – helping them to better themselves and to make a difference," Rogers said. "That’s the way I look at it. Every NFL team was valued at over $1 billion, so they can weather the storm of a lockout. But could players if there weren’t resources to cover this short-term labor dispute?"

Rogers said he wouldn’t put a negative spin on someone seeking a loan during a lockout, but would instead focus on a players' need to obtain high-interest, short-term loans as a “coaching moment.”

"It's not as if financial advisors setting up these loans are just vultures coming in trying to seize the opportunity to make as much money as possible because we’re dealing with professional athletes," Rogers said. "The key is to figure out how to solve the short-term liquidity issue and put the pieces in place to ensure they don’t have this liquidity issue again."

But some veteran players and sports industry executives bristle at the notion that loans at these rates are constructive -- or even necessary.

"Sounds like total B.S.," said Cardinals kicker and NFLPA representative Jay Feely. "I think it's predatory and unjust. I don’t think they should be charging those interest rates and I would encourage every player [considering high-risk loans] to look elsewhere. I think if you went to your bank, or outside lending agencies, you're not going to pay that kind of interest. That’s absurd."

While Feely's point is shared by many in the union, some players simply don't qualify for loans from traditional lenders, which typically generate interest in the range of 3.25 to 10 percent. Complicating things further, the unsecured loans many players seek are reserved for top-tier clients and "are mostly a thing of the past," according to one bank executive. And in the absence of lending from traditional institutions, sports-specific lenders have begun to fill the void in the market.

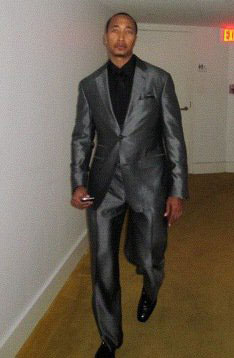

One of those sports-specific lenders is Darien Dash, the Managing Director/Sports of Pro Player Funding. His business is one of a handful of boutique lenders which focus primarily on the business of professional athletics, filling a unique niche in an already-exclusive market.

While Dash would not discuss specifics in order to preserve client confidentiality, he said his company has facilitated lending to "several guys" in the NFL. And although Dash declined to discuss whether he has seen an increase in requests for lending in the run up to the lockout, he emphasized the need for players to secure enough money to survive the work stoppage.

"This is a very pivotal and important negotiation for the players," Dash said. "And to the extent that anybody is providing them with a lifeline or a resource to help them to have the financial wherewithal -- to be able to renegotiate what they feel is a fair labor contract -- I think it’s important.

"I know of five, 10, 15 guys in [the sports-lending] space that are all trying to provide resources to players as they [go through the lockout]. I think it's an important dynamic to understand that this is the war chest, or the leverage that players need to be able to get the best deal."

While Dash expressed concern that players might be entering into these agreements without competent legal counsel -- and indicated his company would never close a deal where the borrower wasn’t represented -- he emphasized that players who secure lending are adults and are ultimately responsible for their actions.

"Nobody's out here forcing these guys to do this -- in terms of putting the gun to their head and making them do it," Dash said.

Dash also doesn’t share Feely's assertion that lending to players at such high rates may be predatory or unjust.

"[Feely] is certainly entitled to his opinion," Dash said. "At the end of the day, the optimum situation would be where they don’t need the capital at all because they’ve been able to save and/or provide themselves with a lifestyle that fits the means of the cash flow that they make. But to the extent that all those things fall down, and they need to go out to the marketplace to access capital, to provide for their families while they go through their renegotiation, to the extent that that capital is available, I think it has a value.

"Whether that value is 24 percent, 10 percent or anything in between those two, that's got to be between the player borrowing the money and the person that's lending to them."

But others in the union pointed out the difficulties players face in securing traditional lending and how that makes them easy marks for opportunistic business people.

"As an NFL player you are a target, as every guy will learn," said Ravens center and NFLPA players representative Matt Birk. "There are a lot of people trying to separate you from your money."

Birk also raised a question: How many players actually need substantial funding at this moment?

"Having [$250,000 to $500,000] to spend or invest -- sure, it’s a nice thing," he said. "But you can get taken advantage of, especially when you’re talking about guys in their twenties. There’s no handbook on how to handle yourself, so you learn some things along the way, and hopefully you don’t lose too big."

And while there is the question of how many players actually have a need for the funds being secured, multiple sources tied to players have told ThePostGame.com there are already some players in dire financial need. And absent an influx of cash, they will find themselves in precarious financial situations.

During the season, NFL players receive game checks with each representing 1/16th of their salary. A handful of players would have received roster bonuses this spring if it had not been for the lockout. But that segment is small in comparison to the percentage of players who have sought these loans.

Some players depend on teammates and other players to shore up any short-fall during the off-season. But because of new belt-tightening, player-to-player lending has dried up.

"I’m being introduced to a lot of prospective relationships with young men who had no real guidance to this point in their career, and were living hand to mouth, literally," the aforementioned prominent financial adviser said. "They’re sitting with [such a relatively small amount of money] in the bank that in five months ... there’s a chance that they’ll be broke."

A spokesperson for the NFLPA declined comment on the high-risk loans players are securing. But at a time when the players are engaged in a financial war of attrition with the owners, the fact that players are already in need of funding -- after only one month of lockout negotiations -- appears troubling. And the longer the lockout drags on, the greater the percentage of players who will aggressively seek out needed revenue. And that aggressive pursuit could eventually have long-term consequences.

"What’s going to happen here, and it’s going to happen to a lot of people, is these guys who are getting loans aren’t going to have the means to pay them back," the financial adviser said. "They’re going to lose their homes. Their credit is going to be shot."

"It’s unfortunate and not the way it should be, but it is the situation we find ourselves in."